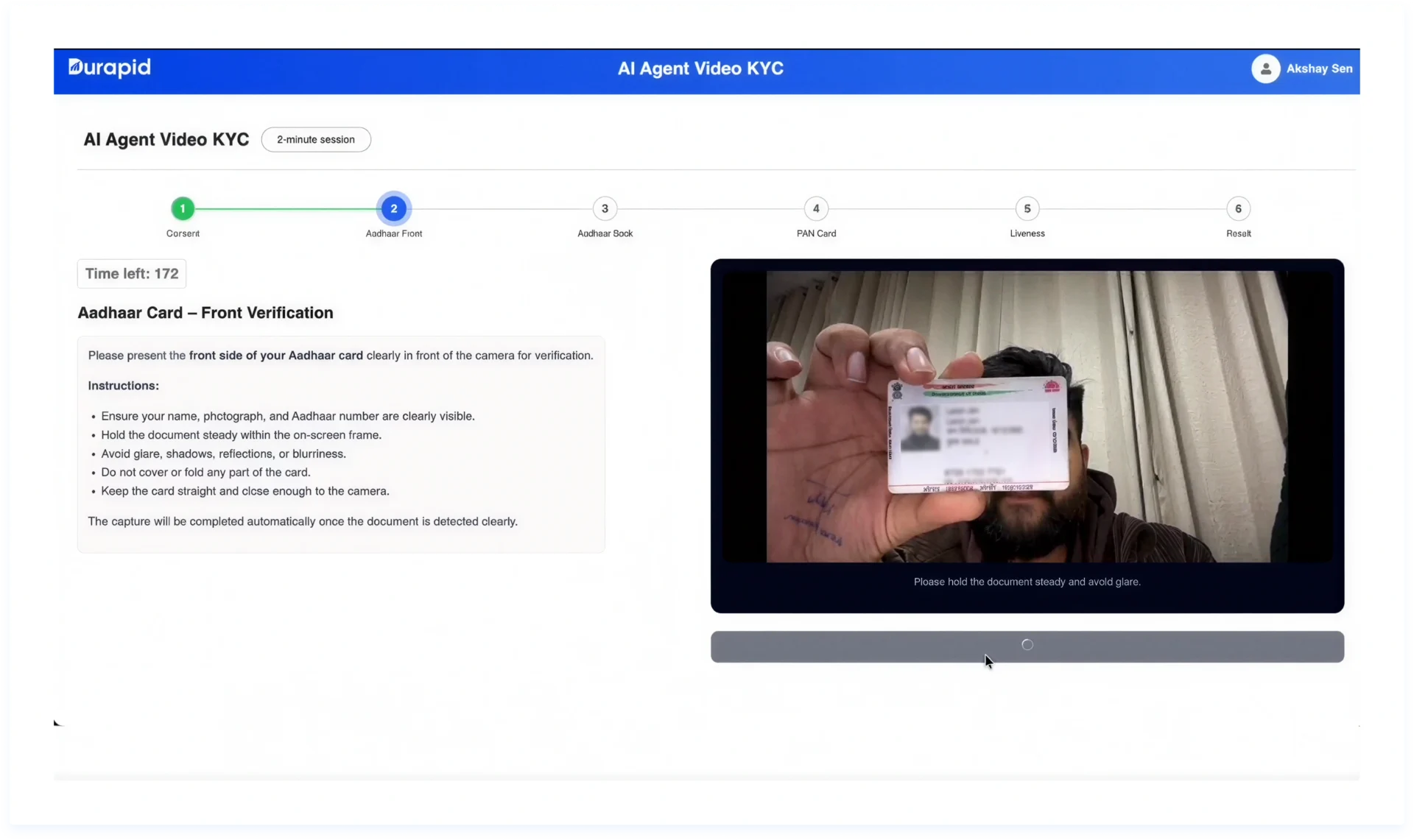

Faster Onboarding: Complete verification in minutes, not days.

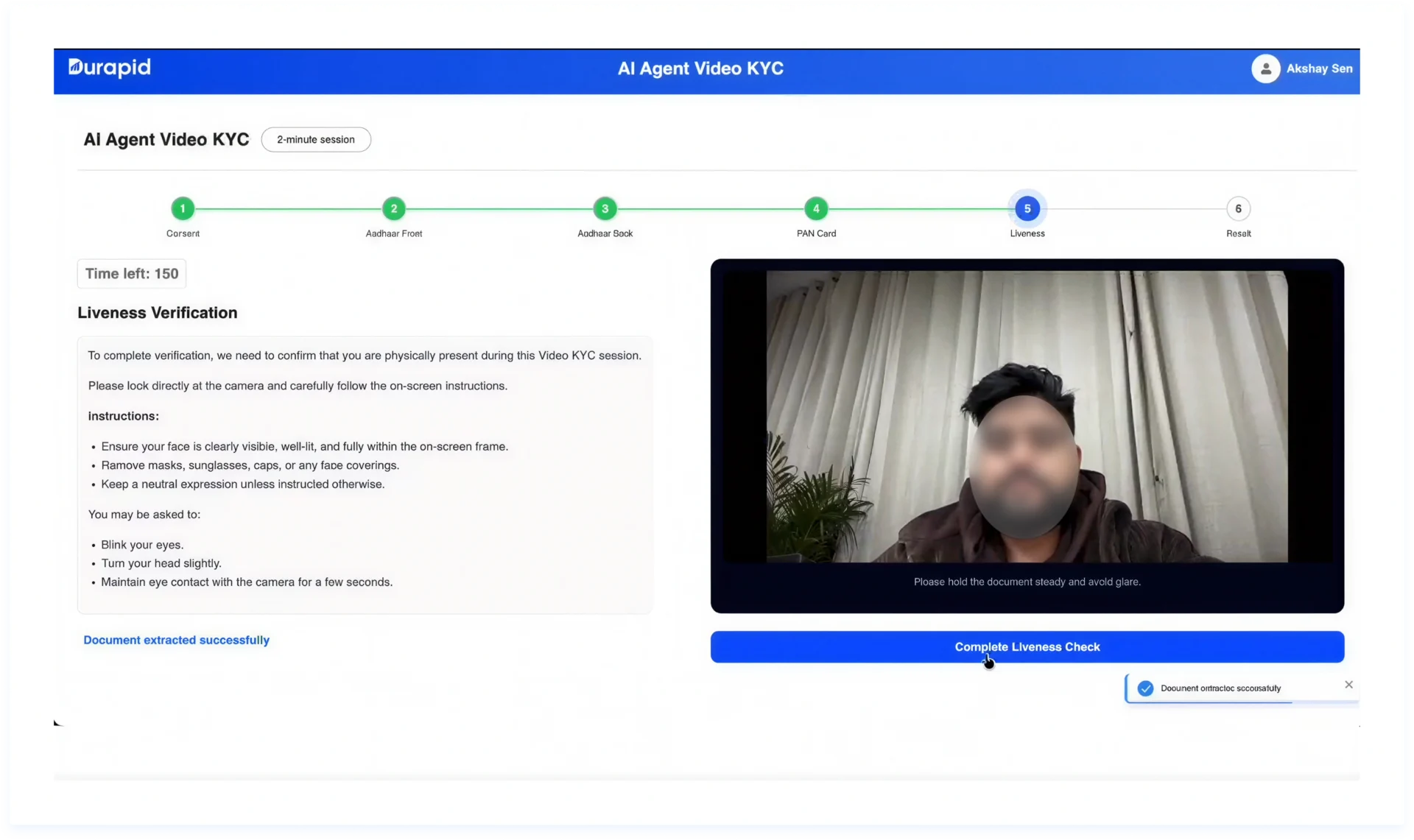

Lower Fraud Risk: Live verification blocks replay, spoofing, and tampering attempts.

Reduced Operational Costs: Minimize manual agents and repetitive review cycles.

Better Customer Experience: Simple and intuitive flow improves completion rates.

Built-In Compliance: Time-stamped logs and audit trails reduce regulatory exposure.

Enterprise-Ready Scale: Handle high concurrent sessions without performance drops.

- Banks and digital banks onboarding customers remotely.

- NBFCs and lending platforms accelerating loan journeys.

- Fintech and payment providers reducing onboarding friction.

- Insurance companies verifying customers with confidence.

- Large enterprises onboarding vendors, partners, and contractors.